Non-Concessional Contributions — the ifs, buts and maybes

Recent changes to the Non-Concessional Contribution (NCC) limits require good peripheral vision across several financial years.

If the total of all your individual superannuation funds exceeds $1.6m, look away now.

For the rest of us, upsizing retirement savings became a little more complex on 1 July 2017 when the ability to make NCCs was limited to a Total Superannuation Balance of $1.6m. If all your benefits across all your Super funds were less than $1.6m, as at 30 June 2018, you can still make NCCs for the 2019 financial year. Remember to consider any defined benefit pension values.

For the 2018/19 financial year, individuals up to the age of 75 years (subject to the "work test") have the ability to make annual non-concessional contributions of $100,000 based on their Total Superannuation Balance as at 30 June 2018.

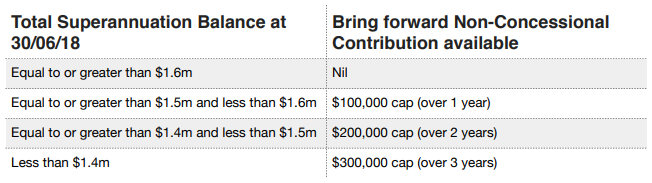

The 3 year bring-forward rule allows the contribution of up to 3 years' annual caps in a single year but there are a number of "ifs" involved here:

If your total superannuation balance as at 30 June 2018 is less than $1.4m your NCC cap is $300,000 for the 3 year bring-forward period; if your total balance is $1.4m-$1.5m your NCC cap is $200,000 for a 2 year bring-forward period; and if your total superannuation balance is $1.5m- $1.6m your maximum NCC is $100,000.

The Federal Government is keen for Australia's ageing population to self support its retirement years and, where possible, continue to live independently. Retirement living on a healthy superannuation balance remains a more attractive option than the government pension scheme, so if you have surplus funds maybe it's time to consider your superannuation bottom line.

But, and there's always a "but", while these NCC changes still enable additional superannuation contributions, the latest NCC cap reductions continue to diminish the possibility of earning income at lower tax rates.

With a federal election on the horizon and superannuation a constant area for political tinkering, maybe it's worth contacting us at Oxygen Private Clients. The NCC cap changes are certainly something to consider before the May 2019/20 Federal Budget.

For Self-Managed Superannuation Fund holders wanting to make NCCs for the 2018/19 financial year, the financial statements for the 2017/18 financial year need to be finalised to be certain of the Total Superannuation Balance. This is particularly the case if your Total Superannuation Balance is close to $1.6m.

With ongoing changes to NCCs and other superannuation legislation, expertise and sound advice are key elements here. Contact Helen McPhee, Senior Manager -- Superannuation 03 9977 2600

#superannuation #finance #wealth #money #planning #oxygenpc #australian